Zamara Group has entered into a Memorandum of Understanding with the Kenya National Federation of Jua Kali Associations (KNFJKA) aimed at driving financial inclusion to the informal sector to enable saving, protection from old-age poverty, and pertinent risks that come along with the life cycle of the average Jua Kali worker.

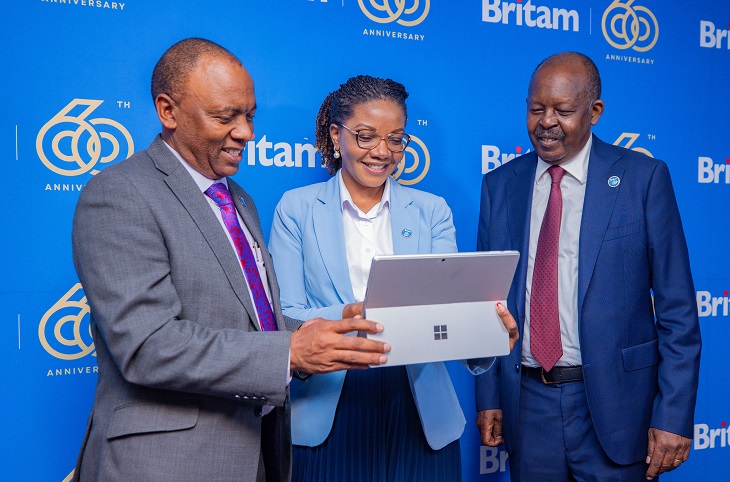

The two parties have come to an agreement seeking ways to continue with the existing framework aimed at the protection of the sector’s members.

The first initiative within the partnership is the rollout of Zamara’s Savings and retirement product, Fahari Retirement Product to over 18 million members across the country.

The Fahari Retirement Plan is an innovative individual retirement solution targeted to the individuals within the productive age of the population to save for their future. The majority of whom are active in the informal sector.

Speaking during the signing ceremony held at Serena Hotel, Zamara Group Chief Executive Officer said, “We recognize that in the current environment we live in, the best way to have an adequate income for the future when you are not agile to work anymore is to gradually save as much as you can while you are still strong enough to work.

“Pension schemes, especially individual pension schemes like Fahari, are fundamental in the journey towards financial security. Roughly speaking, if two individuals aged 20 and 30 starts saving Sh500 every month up to age 55, their savings earn 10% per year compounded every year month. The 20-year-old would have around Sh 2.7 million at age 55, while the 30-year-old would have around Sh 1.08 million at age 55. This means that the value of an individual’s savings depends on their contribution level and how early you start saving for your future,” Mr. Raichura added.

On his part, Richard Muteti, H.S.C. Chief Executive Officer, Kenya National Federation of Jua Kali Associations said, “We are grateful to Zamara for identifying this gap and initiating the process to accord the sector a solution that will offer our members a dignified future, especially when they are no longer strong and agile enough to continue with their work for the much-needed income. The savings solution we are launching today is a game-changer and will be a great determinant of how you finish your financial journey”

Financial Inclusion in the country has been limited to a small segment of the population within the formal sector and the penetration within the informal sector has perennially been low due to the lack of communication that speaks to the specific needs of the sector.

“The Jua Kali sector is largely seen as an informal sector in Kenya whose importance to the economic development of the country cannot be underestimated. The sector represents an integral part of the economy and indeed of the labor market. In many countries, our sector plays a significant role in employment creation, production, and income generation. In Kenya, we, the Juakali sector represent 83% of employment opportunities,” Mr. Muteti added.

“I believe that this is the first of many partnerships. Through this, we will grow together by providing pensions solutions and progress this to other spaces to also meet your insurance needs,” Mr. Raichura concluded.

[…] Read More: Zamara Joins Hands With Federation Of Jua Kali Associations […]