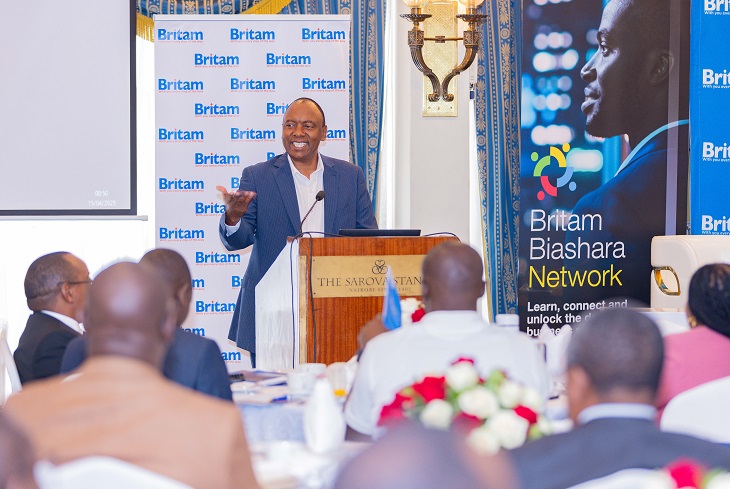

Kenyan small and medium enterprises (SMEs) are walking a tightrope, squeezed by global tariff wars, rising local taxes, and limited access to affordable credit, forcing a fresh call for resilience, strategy, and innovation. This was the stark reality laid bare at the Britam Biashara SME Forum held on April 15 at Nairobi’s Sarova Stanley Hotel, where industry leaders and entrepreneurs gathered to tackle the critical issues threatening the backbone of Kenya’s economy.

At the forum, Florah Mutahi, Director at the Kenya Association of Manufacturers (KAM) and Founder & CEO of Melvins Tea, said, “SMEs are struggling, but let’s be honest, it starts with the entrepreneurs themselves.” Adding, “Many have brilliant ideas but lack clarity, structure and strategy. Before we talk about taxes or global shocks, we must look inward.”

Mutahi, a 30-year veteran in the business world, painted a sobering picture of the global landscape, pointing to the ripple effects of escalating trade tensions between economic giants like the US, China, and Europe. “The protectionism we’re seeing globally is worrying,” she warned. “Take AGOA, for example. Kenya exports about 400 million dollars’ worth of goods to the US. A 10 percent tariff imposed on these goods, like tea, can determine whether a business succeeds or fails.”

For exporters like Mutahi, the impact is personal. “In tea, that 10 percent is huge. The only way to absorb it is through branding or cutting costs elsewhere in the value chain, which is already stretched,” she explained. “Governments can’t shield us from global shocks, but they must keep negotiating trade access to avoid isolation.”

She warned that as countries increasingly turn inwards, focusing on local production and shielding their markets, Kenyan SMEs, especially exporters, will find it harder to compete and survive without bold shifts in how they operate. “The only option is to buckle down, build strong brands, cut internal inefficiencies and stay competitive.”

Beyond international trade, Mutahi flagged persistent challenges in local market access and the often-repeated issue of financing. However, she challenged the notion that funding is the number one barrier. “We did a survey and found that access to finance is number five. The real issues are self-management, productivity, hiring right, and having a clear business strategy. Only then does money matter,” she explained.

Britam General Insurance CEO James Mbithi backed this sentiment with a call for risk preparedness. “Over the past two years, we’ve held forums across Kenya to understand SME pain points. One thing is clear: most are exposed to huge risks, from fire to floods to cyber threats. One incident can wipe out years of effort,” he said.

To cushion SMEs, Britam has developed Britam Biashara, a simplified insurance product tailored to the realities of Kenyan entrepreneurs. “Traditionally, an SME would need to buy over 10 different insurance covers. We’ve bundled everything into one product—covering property, employee liabilities, theft, business interruption, and more,” said Mbithi.

The product offers flexible payment plans, making it accessible even to businesses with irregular income flows. Britam also launched the Milele SME Health Plan, a comprehensive health insurance package designed for SMEs with as few as three employees. It includes inpatient, outpatient, dental, maternity, and mental health coverage, providing a safety net that is increasingly critical in a climate where one medical emergency can derail a small business.

“Our goal is simple,” Mbithi said. “Safeguard the dreams and hustle of Kenyan SMEs by protecting what they’ve built and keeping their teams healthy and stable.”

Related Content: KRA Offers SMEs A Fresh Start Through The Tax Amnesty Window