Asking why you need Chapa Pay for your business is like asking why you need to take your business online. Honestly, if your business is not both offline and online in this age and time, you actually have no business being in business. In other words, you are not being serious.

Having your business online comes with many advantages; you get to reach as many potential customers within as short a time as possible. It is also cheaper for most online tools such as social media will come to you free of charge. What are you still waiting for?

Now, back to Chapa Pay. What is Chapa Pay? This is an e-Commerce solution from the Co-operative Bank of Kenya that allows you to receive online card payments from your customers directly into your Co-op Bank account. As easy as that.

It makes no sense to move your business online with limited options of how people can make payments when purchasing your products and services. Many businesses online are limited to Paybill or Lipa Na M-Pesa till numbers as the only modes of payment.

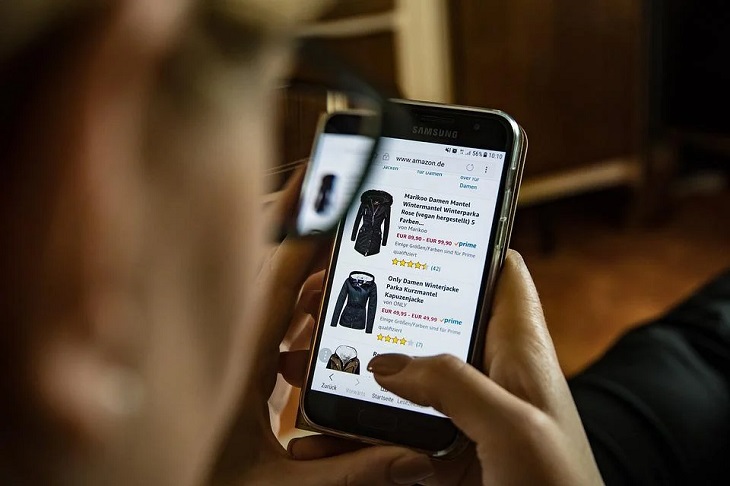

Chapa Pay eliminates this hindrance to you receiving payments from your customers. It is meant for merchants who sell their products and services via online platforms such as WhatsApp, Facebook, Instagram, Twitter, and also via websites.

The service is easy to onboard and it is free of charge. Co-operative Bank does not charge anything. It is all between the merchant and the customer. Once the merchant and the customer agree on the pricing, the merchant sends the payment link to the customer’s email address.

The customer will receive an invoice with the link on their email. The link will open up a portal where the customer will insert their card details and the amount they are to pay. It is that easy.

2 comments

[…] devices that are connected enabling a greater percentage of the population to access services, from banking, education, and health right from their mobile […]

[…] devices that are connected enabling a greater percentage of the population to access services, from banking, education, and health right from their mobile […]

Comments are closed.