UBA Kenya has taken a bold step to ease the financial burden on borrowers. The bank has reduced its base lending rate from 16.22% to 14.79%, a move that underscores its commitment to making credit more affordable and accessible.

This reduction not only aligns with global and regional efforts to foster financial inclusion but also positions UBA Kenya as a go to financial partner for credit access.

The reduction in the base lending rate is more than just a numerical adjustment—it is a game-changer for businesses, individuals, and entrepreneurs who rely on credit to grow and sustain their ventures.

For SMEs, which are the backbone of Kenya’s economy, lower interest rates mean reduced loan servicing costs, allowing them to reinvest in their businesses, create jobs, and drive economic growth.

Individuals seeking personal loans for education, homeownership, or emergency needs will also benefit, as the cost of borrowing becomes more manageable. In an era of rising living costs, every shilling saved on loan repayments can go a long way in improving financial well-being.

UBA Kenya’s decision to lower its lending rate is not just about affordability—it is about accessibility. High interest rates often lock out a significant portion of the population from accessing credit, limiting economic participation and financial growth. By offering lower rates, UBA Kenya is breaking down these barriers, ensuring that more Kenyans can leverage financial services to achieve their goals.

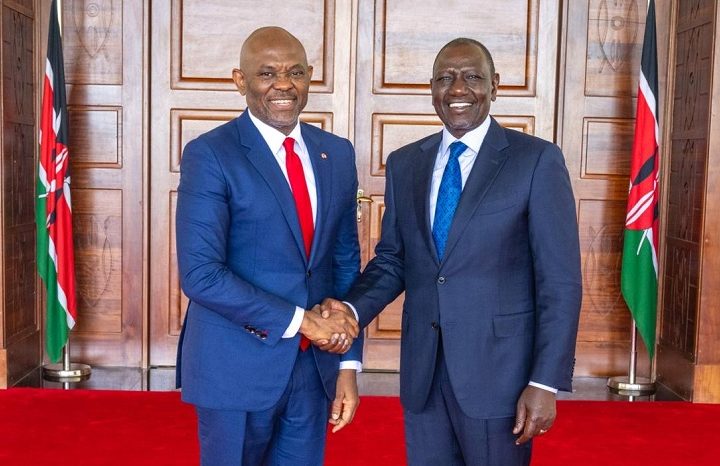

UBA Africa CEO Abiola Bawuah during her visit in Kenya held a series of meetings with government officials and stakeholders and explored opportunities that will empower Kenyan SMEs to grow their businesses in Kenya and across the continent.

The move by UBA Kenya comes at a time when economic resilience is more critical than ever. With the financial landscape constantly evolving, businesses and individuals require supportive banking partners who can offer flexible and competitive credit solutions. By making loans more affordable, UBA Kenya is fostering a climate where businesses can expand, startups can thrive, and individuals can invest in their futures with confidence.

Moreover, the reduced lending rate aligns with Kenya’s broader financial sector reforms aimed at creating a more inclusive and competitive banking industry. The Bank is showing that financial institutions have a crucial role to play in driving economic development and social progress in the economy.

In the fast-paced world of finance, institutions that listen to their customers and respond proactively stand out. UBA Kenya has demonstrated that it understands the needs of its customers by not only offering lower rates but also ensuring that its financial products remain customer-centric, flexible, and innovative.

For businesses looking for capital, individuals seeking financial support, and entrepreneurs eager to scale their operations, UBA Kenya’s lending rate reduction is a signal of opportunity. It reaffirms the bank’s position as a financial partner dedicated to supporting growth, stability, and prosperity in Kenya.

Related Content: United Bank For Africa Reinforces Commitment To Support SMEs In Kenya