Stanbic Bank took center at the ongoing China-Africa Economic Trade Exhibition (CAETE) from 9th May -11th May 2024, reaffirming its commitment to strengthening relations between Africa and China. As the expo concludes today, Stanbic Bank’s presence emphasizes its critical role in the future of economic collaboration between the two regions.

Trade is the key to long-term, sustainable economic growth in Africa. It has grown modestly in recent decades, expanding from 49 percent of GDP in 2000 to 53 percent by 2019, according to the International Monetary Fund’s 2023 report on Trade Integration in Africa.

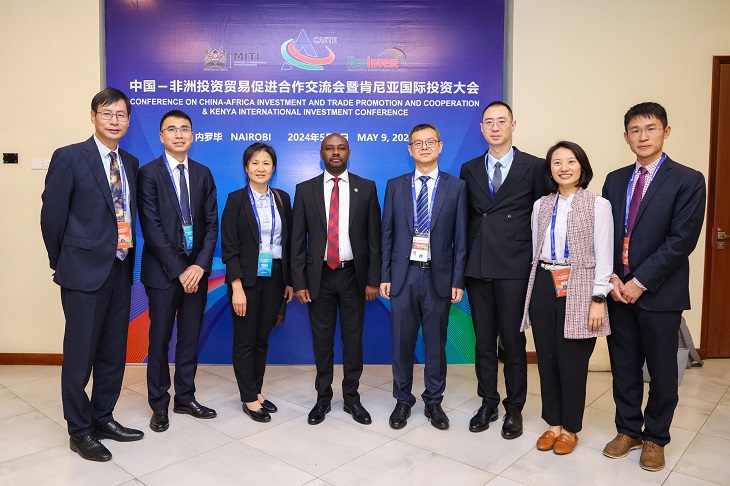

Paul Mungai, Head of Trade and Africa China Banking at Stanbic Bank emphasized the bank’s pivotal role in mitigating risks and facilitating seamless transactions during the China Africa Economic Trade Exhibition (CAETE) at the Edge Convention Center in Nairobi.

“With over 1.4 billion people, China is critical for Kenyan businesses in offering a wide market for local export produce. Stanbic Bank offers access to the China market through solutions that catalyze growth, mitigate risks, and meet product and market demand,” added Mungai.

Stanbic Bank Kenya is part of the Standard Bank Group, whose single largest shareholder is the Industrial and Commercial Bank of China (ICBC). As the largest bank in the world with a significant 20.1% shareholding, ICBC’s unique presence complements Stanbic Bank’s extensive footprint across Africa. Together, the two financial powerhouses facilitate access to international capital, enabling growth and diversification for African businesses.

In 2022, the collaboration between Stanbic Bank and ICBC facilitated trade flows valued at $600 million, solidifying their position as leaders in Africa-China trade and investment facilitation. Moreover, the partnership serves as a conduit for identifying and communicating commercial opportunities to governmental authorities in Africa and China, further bolstering bilateral cooperation.

Related Content: Stanbic Facilitates Ksh 4.3 Billion Term Debt Facility For NCCL