Rubis Energy Kenya has expanded its petroleum product market share by bailing out the National Oil Corporation (NOC) of Kenya Ltd.

Rubis Energy Kenya has partnered with NOC Kenya through a specific procurement process known as the Specially Permitted Procurement Procedure (SPPP).

Under the SPPP process, Rubis Energy Kenya will be a non-equity strategic partner or a partner that contributes expertise, resources, or services but does not take ownership in the entity which in this case is NOC Kenya.

Leparan Ole Morintat, CEO & Managing Director of NOC said that the state-owned petroleum company was in financial straits and its future depended on it getting substantial capital injection which was only possible from a strategic partner because the government is also financially strained.

“This sector is highly complex and capital-intensive, requiring substantial investment and operational flexibility to stay competitive. Given the significant demand for government resources, securing shareholder capital injection was not feasible. As a result, NOC sought a non-equity strategic partner to provide the financial support and technical expertise needed to revitalize the company and restore profitability. This process, initiated in 2019, has now culminated in the selection of Rubis Energy Kenya as our non-equity strategic partner.”

Related Content: RUBiS Energy Kenya Takes Over National Oil Corporation

The bailout will see Rubis Energy take over NOC Kenya’s prime service stations including rebranding. The two companies did not indicate how many stations will be affected or their status but in its salad days, NOC Kenya operates over 100 fuel stations through a mix of ownership models, including direct ownership, franchises, and contract arrangements.

EPRA data indicates Rubis held a 15.56% market share, ranking second behind Vivo Energy Africa’s 22.4%. NOC Kenya data was not captured due to the failure of the company to run its operations.

As part of the partnership, Rubis Kenya will settle legacy debts, some of which, have been flagged by the Office of the Auditor General.

“In addition, an estimated 390,000 litres of diesel destined for Geothermal Development Corporation was lost while in the custody of the contracted transporter. This was disputed by the transporter in 2019 and the matter was still pending before the High Court,” says the report ended June 2022.

Other issues the Office of the Auditor cited included inaccurate balances, unsupported funds, inventory issues, unresolved losses, unsupported payments, unspecified allowances, and unsupported board expenses.

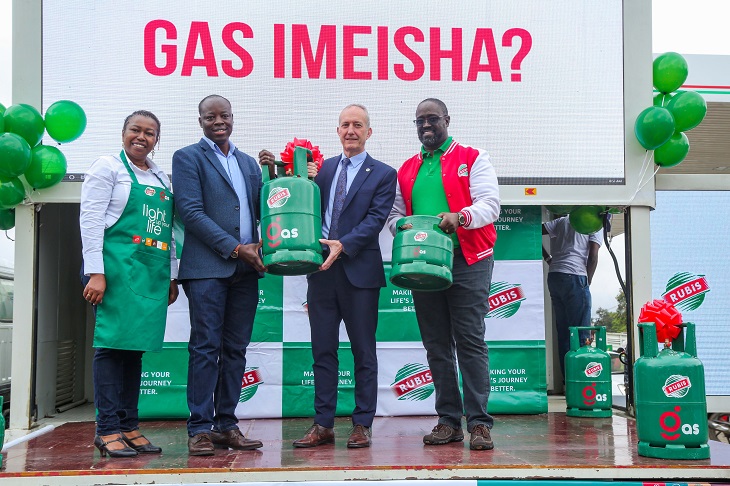

Related Content: Rubis Now Launches Its Own Line Of Cooking Gas