United Bank for Africa (UBA) celebrates 75 years of dedicated service, marking a significant milestone in its journey of delivering excellence and innovation in banking across Africa and globally.

The bank held a global media conference showcasing the Bank’s journey since its establishment in 1949 to become the leading financial institution in Africa with operations in 20 African countries: and major international trade cities New York, London, Paris, and Dubai. UBA is uniting Africa while connecting Africans to the World and the World to Africa. The primary focus for UBA is to be the payment bank for Capital flows, trade, and investments between Africa and the rest of the world.

Speaking at the event, Oliver Alawuba, Group Managing Director/CEO, of UBA Plc, highlighted key milestones that have defined UBA’s legacy to becoming a pan-African bank with a global presence. He noted that UBA has continued to foster partnerships for growth and economic prosperity. He acknowledged the contribution of leadership and staff and gave special recognition to Mr. Tony Elumelu CFR for his visionary leadership and role in shaping the Bank’s footprint and achievements. Mr. Alawuba attributed the Bank’s success to digital transformation, customer 1st principle, and resilience to changing economic conditions. Alawuba reinforced UBA’s commitment to a vision for the future through innovative financial solutions and personalized banking experiences for its customers.

UBA remains committed to simplifying cross-border transactions and providing solutions that facilitate seamless trade across Africa. This is through partnerships and innovative products designed to support businesses in their growth journey.

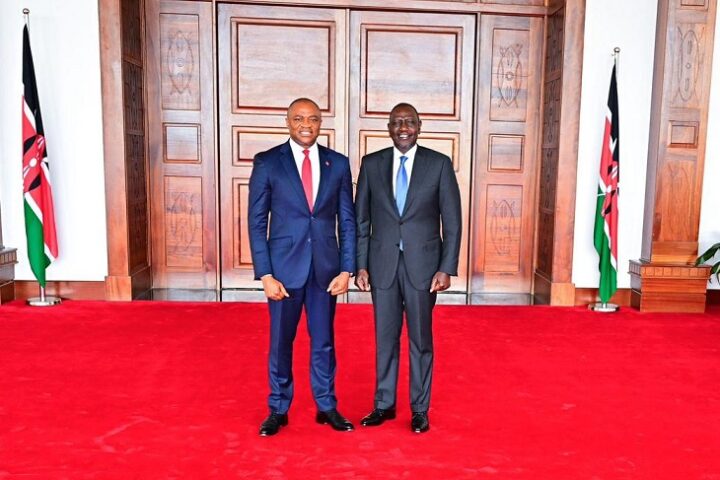

Ms. Mary Mulili, UBA Kenya MD/CEO stated that UBA Kenya simultaneously also celebrates 15 years of presence in providing financial services in the Kenyan market and is proud to be part of the successful journey of UBA Plc’s 75th anniversary celebrations. This milestone shows UBA’s commitment to impact, seizing growth opportunities, and delivering value to its customers. She added, “Collaboration and partnerships as exemplified by the $6bn SME funding agreement signed with the African Free Trade Area (AfCFTA) will be instrumental in achieving our strategic objectives. We are dedicated to deepening relationships with customers, employees, regulators, and other stakeholders for mutual benefit and long-term success. UBA Kenya has allocated USD 282 million over the next 3 years for SME funding through this partnership. We remain committed to supporting SMEs and we recognize the financing and market access gaps that we are stepping into a bridge. SMEs play a pivotal role in Kenya’s economy and contribute to over 90 percent of the total labor force. UBA remains a go-to financial partner for SME growth and is in line with our strategic focus on the SME segment being a catalyst to the economic development in Kenya.”

Related Content: UBA Marks 75 Years Of Banking Transformation, Marks 15 Years Presence In Kenya