Liberty Kenya Holdings CEO Kieran Godden has reaffirmed the company’s commitment to strengthening its core underwriting operations, following a year of exceptional investment returns.

Speaking in an interview with Business Daily, Godden emphasized that long-term profitability must be rooted in sound insurance fundamentals.

“Underwriting is what we do. Our job is to manage risks,” he said, noting that while Liberty’s net investment income surged 3.3 times to Ksh 4.74 billion in 2024, the company remains focused on sustainable earnings growth.

Godden stressed that although strong investment performance is beneficial, particularly for shareholders, it is the underwriting results that truly define the company’s financial health. “Investment returns are great and certainly valuable to shareholders, but the real value comes from consistent underwriting profits,” he explained.

Looking ahead, Liberty has identified promising growth opportunities in emerging areas of insurance. The company is witnessing rising demand for marine and cyber insurance, driven by increased digitalization across sectors. In addition, there is growing interest in health and wellness products, including mental health coverage, following the heightened awareness brought on by the pandemic.

Godden also addressed Kenya’s persistently low insurance penetration, which remains below three percent of GDP. “It comes down to two key issues: a lack of trust and a lack of understanding,” he said.

To address these challenges and enhance customer confidence, Liberty has intensified its anti-fraud initiatives, especially in the health and motor insurance segments, through investments in advanced data analytics and machine learning tools. The insurer is also working closely with industry peers and regulators to improve information sharing and combat fraudulent claims more effectively.

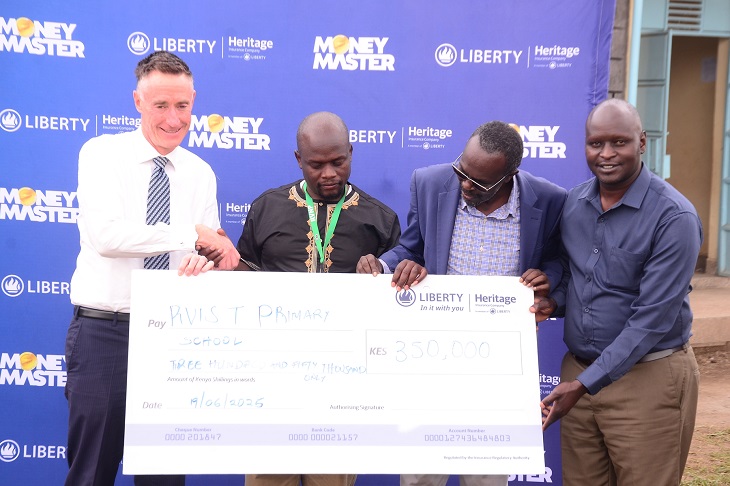

Related Content: Liberty Kenya Donates MIT-Backed Computers And ECDE Chairs To RVIST Primary