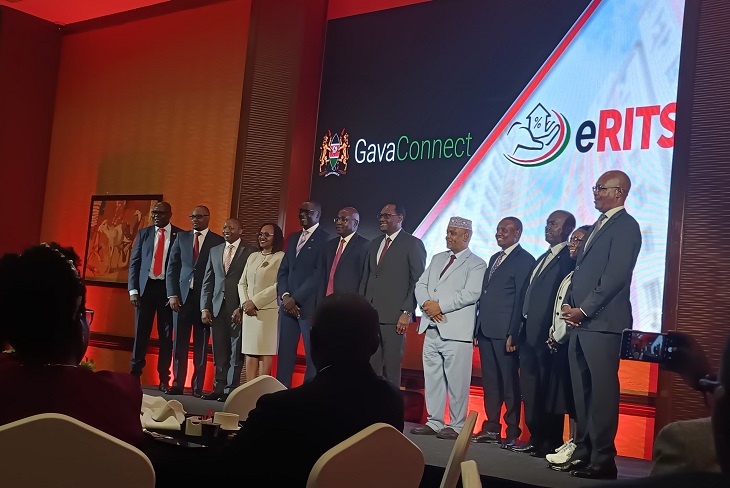

Kenya Revenue Authority (KRA) has officially launched the Electronic Rental Income Tax System (eRITS) to simplify tax compliance for property managers and owners across the country.

This is the first time KRA is coming up with a dedicated portal for Kenyan landlords and property owners in an effort to streamline revenue collection as well as remove the hustle of rental income filing and consolidation.

Working almost similar as eTIMS, the eRITS system enables property managers and owners to have their property on one platform for easy management and accountability.

“As part of KRA’s broader digital transformation under the Enterprise Integration and API Management (EAPI) initiative, our commitment was to make it easier for taxpayers to meet their obligations while improving the overall compliance experience,” said KRA Commissioner General Humphrey Wattanga.

According to KRA, the Electronic Rental Income Tax System (eRITS) has been developed to simplify tax compliance from a technology perspective, for the monthly rental income regime.

“The EAPI initiative anchors our roadmap towards Tax Administration 3.0 where technology and governance unite for improved service delivery, operational efficiency and stronger collaboration with stakeholders,” added Wattanga.

Over the years, the rental income sector has remained a vital component of Kenya’s economy however, complexities and unique dynamics associated with the sector have over time, had a significant impact on compliance.

Despite these intricacies, KRA has continued to experience sporadic year-on-year growth in terms of revenue collection. In the last financial year 2023/2024, the Monthly Rental Income registered a collection of 14.4 Billion translating to a 5.2 percent year on year growth compared to a collection of 13.6 Billion shillings and 12.3 Billion shillings in the previous financial years 2022/2023 and 2021/2022 respectively.

“eRITS is therefore designed to enable seamless integration with the KRA ecosystem for purposes of tax computation, filing and payment; and is accessible through the Gava Connect API portal for system-to-system integration, and as a service through the eCitizen platform. The intention is to augment voluntary compliance within the sector while reducing administrative burdens associated with taxation,” said Wattanga.

Speaking during the launch, Principal Secretary, National Treasury, Dr. Chris Kiptoo, lauded KRA’s efforts to enhance compliance within the real estate sector in Kenya. He said the government is committed to ensuring that taxpayers conveniently pay their taxes as an obligation and not as a punishment.

“For years, the government has made concerted efforts to bring landlords into the tax net, but our previous systems have faced considerable challenges. Despite reducing rental income tax from 10% to 7.5% to encourage compliance, the Government has only been collecting Ksh 17 billion annually from rental income tax, whereas estimates suggest that the potential revenue is at least Ksh 100 billion. This can be translated to only 17% of the revenue collection against the potential target,” said Dr. Kiptoo.

According to the Commissioner of Micro and Small Taxpayers, Mr. George Obell, the new system will help bring more landlords into the fold and make the experience easy for them. He said that landlords remain a great component of Kenya’s economy and are helping the government’s push for affordable housing for all.

Related Content: KRA Given Right To Levy Value Added Tax On Disposal Of Land