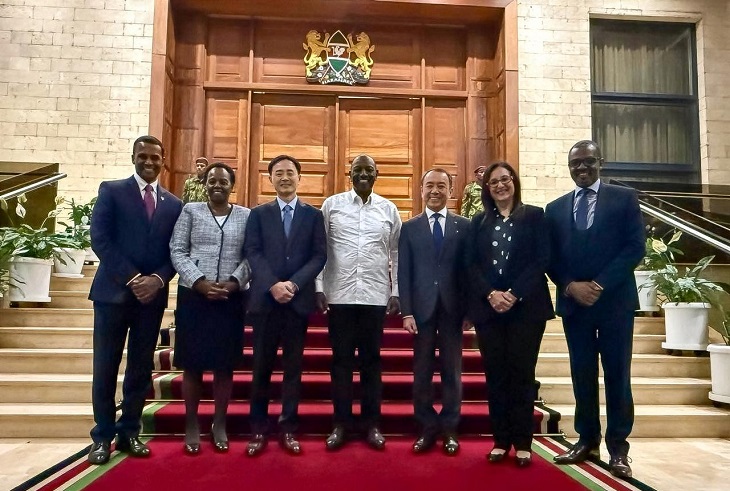

Kenya’s investment narrative received a significant boost following President William Ruto’s meeting with the leadership of Japan’s Asahi Group, who briefed him on the acquisition of the 65 per cent shareholding previously held by Diageo in East African Breweries Limited (EABL).

With this transaction, Asahi Group now becomes the majority owner of one of East Africa’s most iconic consumer goods companies, marking a pivotal moment for Kenya’s manufacturing, agribusiness, and capital markets landscape.

For EABL, a company whose brands have been woven into the social and economic fabric of the region for decades, the change in shareholding signals continuity anchored in long-term vision. For Kenya, it represents something even larger: the arrival of a global investor renowned for patience, operational excellence, and deep-rooted partnerships in markets where it chooses to plant its flag.

A long-term investor with a proven track record

Asahi Group is not a speculative investor. Its global footprint has been built through deliberate, long-horizon investments that focus on value creation, technology transfer, and strong governance. Across Asia, Europe, and the Americas, Asahi has demonstrated an ability to preserve heritage brands while modernising operations, expanding export potential, and embedding sustainability at the core of business strategy.

That philosophy aligns neatly with Kenya’s own economic ambitions. As the government pushes an agenda centred on industrialisation, export growth, job creation, and value addition, Asahi’s entry as a majority shareholder in EABL offers a practical case study of how foreign direct investment can go beyond capital injection to deliver structural impact.

What this means for EABL

EABL sits at the intersection of manufacturing, agriculture, logistics, and retail. From barley and sorghum farmers to distributors, hospitality businesses, and exporters, the company supports thousands of livelihoods across the region. Majority ownership by Asahi Group is expected to strengthen this ecosystem through renewed capital investment, enhanced operational efficiencies, and access to global best practices.

Industry watchers expect a sharper focus on innovation—both in products and processes. Asahi’s experience in premiumisation, low- and no-alcohol beverages, and sustainable brewing technologies could unlock new growth segments for EABL, catering to evolving consumer preferences while maintaining affordability and quality in mass-market brands.

Equally important is the potential to deepen EABL’s export footprint. With Asahi’s global networks, Kenyan-made beverages could find expanded routes into international markets, positioning Kenya not just as a consumer base but as a production and export hub for the region and beyond.

A win for Kenyan farmers and local supply chains

One of the less glamorous but most impactful aspects of EABL’s operations is its agricultural value chain. Thousands of Kenyan farmers supply raw materials, particularly sorghum and barley, under structured contracts that provide stable incomes and predictable demand.

Asahi’s long-term investment outlook suggests continuity—and likely expansion—of these arrangements. Increased production capacity and new product lines typically translate into higher demand for locally sourced inputs, reinforcing the government’s push for inclusive growth that reaches rural economies.

Investor confidence and capital markets signal

The transaction also sends a strong signal to global investors watching Kenya. At a time when emerging markets are competing fiercely for patient capital, a major multinational choosing to deepen its exposure to Kenya underscores confidence in the country’s macroeconomic direction, regulatory environment, and consumer market potential.

For the Nairobi Securities Exchange and Kenya’s broader capital markets, the move reinforces the value of well-governed, transparent, and regionally dominant firms. It also highlights the role of Kenya as a gateway to East Africa—a market of more than 300 million people.

Government–private sector alignment

President Ruto’s engagement with Asahi Group leadership reflects a broader strategy of economic diplomacy: actively courting investors who bring not just capital, but technology, skills, and long-term commitment. The meeting underscores the administration’s message that Kenya is open for business, particularly to partners aligned with sustainable growth and local value creation.

Asahi’s majority ownership of EABL fits squarely within this narrative. It is a reminder that transformational investment is often measured not in headlines, but in decades—through factories expanded, farmers empowered, jobs sustained, and brands grown responsibly.

As EABL enters this new chapter under Asahi Group’s majority ownership, expectations are high—but grounded. The true measure of success will be seen in how effectively global expertise is blended with local insight, how growth is shared across the value chain, and how Kenya leverages this investment to strengthen its industrial base.

What is clear, however, is that Kenya has attracted a partner known for staying the course. In an era of short-term capital and rapid exits, Asahi Group’s long investment history offers something increasingly rare—and immensely valuable: confidence in the future.

Related Content: Diageo To Exit Direct Ownership Of EABL Stake As Asahi Steps In