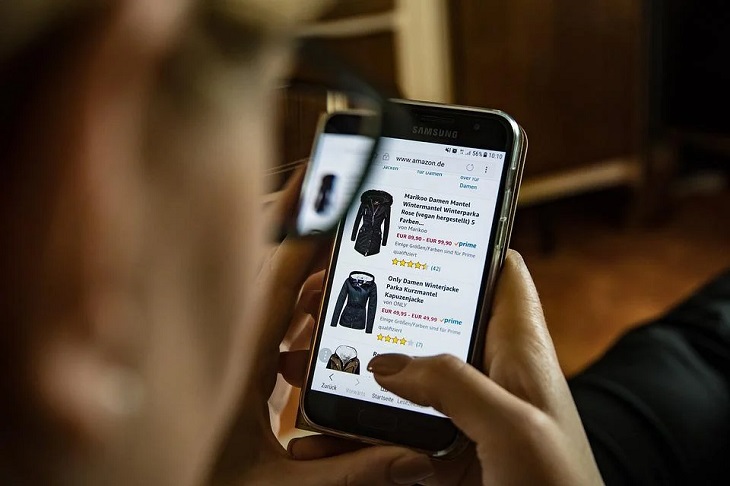

Most businesses worldwide have adopted the use of online platforms to sell their products and services. The most common platforms used are websites and social media tools such as Twitter, Facebook, Instagram, and WhatsApp.

The coming of the Covid-19 pandemic made the world realize that there was power in using online platforms, not just for socializing but to amplify and sell products and services too. In Kenya, most SMEs have moved their products and services online.

Despite the fact that online platforms have been instrumental in empowering businesses in Kenya, the majority of them have been limited when it comes to payment modes. Most of them only use two methods; Lipa Na M-Pesa and cash.

It is on the premise of giving SMEs more payment options that the Co-operative Bank of Kenya came up with the Chapa Pay, an e-commerce product that enables merchants in the SME sector to maximize how they receive payments from customers within and without the country.

The e-Commerce solution is suitable for merchants who promote their goods and services on the online space, e.g. via a website, social media platforms, and WhatsApp among others. It helps them get more customers by accepting online card payments via Chapa Pay, Co-op Bank’s eCommerce solution!

The most interesting thing about this product is that one does not have to have a website. It is a product for everyone. What it does is it enables one to receive card payments from any part of the world. For instance, if one sells goods on WhatsApp, all he/she has to do is to generate a link, send it to the buyer and the buyer will make the payments. Simple.