Family Bank set aside a whopping 50 billion shillings just for women. No other bank has done that. The new product is called Queen Banking and is tailored towards empowering women in Kenya financially by giving them funds to invest and better their businesses.

“Family Bank is dedicated to empowering women in the world of finance. We understand the unique challenges faced by women, whether you are a business owner, a professional, or a group of women seeking financial growth, we are committed to providing the support needed to thrive,” says the lender on their website.

There is no doubt that Kenyan women dominate various economic sectors. According to the Economics Kenya Labour Force Report 2022, women form 49.7 percent of Kenya’s total labor force, make up 50.3 percent of Kenya’s total population, and 40 percent of micro and formal SMEs are owned by women.

Now, how can a Kenyan woman take advantage of Queen Banking products? Easy.

The easiest way is to open an account with Family Bank if you do not have one. It is easier to access this product if you are a customer of Family Bank than when you are an “outsider.” You will not be told this but you have to take it seriously for it will help you.

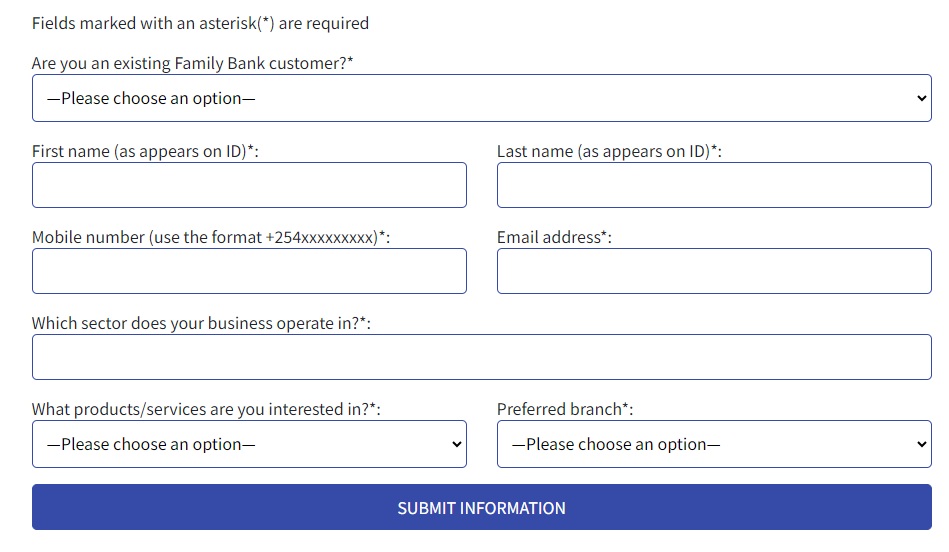

The second and best way is for you to fill out an online form on joining Queen Banking by Family Bank. The online form can be filled out through this link https://familybank.co.ke/fbl_queen/ and it will take you at least 20 seconds to be done with the whole process.

Here is what the form looks like:

After submitting your form, the bank will reach out to you. You can access up to 7 million shillings in secured and unsecured loans through Biashara Boost, unsecured lending of up to 2.5 million shillings to finance women doing piped water business supporting the community.

Women can also get unsecured lending of up to 10 million shillings for working capital and construction of schools with up to 95 percent for school bus financing, unsecured loans of up to 2 million shillings for agri-business input loans, trade finance solutions, lifestyle benefits through strategic partnerships, Chama savings and investment options as well as bundled insurance solutions.

Related Content: Family Bank Sets Aside Ksh 50 Billion For Women-Exclusive Banking Proposition