Britam Holdings Plc has posted a 52 percent rise in pre-tax profit to 7.3 billion shillings for the year that ended December 31, 2024 from 4.8 billion shillings recorded at the same time in the previous year.

During the period, Britam’s insurance revenue increased to 37.6 billion shillings, reflecting a 3 percent increase from 36.4 billion shillings in 2023 on the back of a profitable topline growth.

The uplift was bolstered by growth in both the Kenya insurance businesses as well as the general insurance regional business, which contributed 27 percent (10.3 billion shillings) of the insurance revenue in the year, reinforcing that regional businesses remain a key pillar of Britam’s geographical diversification strategy.

Kenyan businesses delivered a pre-tax profit of 6.1 billion shillings, making them the largest contributors to Britam’s profits for the year under review. Regional businesses, on the other hand, contributed 1.2 billion shillings to the Group’s pre-tax profit.

The Group’s investment strategy, geared towards optimization for competitive returns, resulted in a 163 percent increase in net investment income to 30.6 billion shillings.

The Group’s balance sheet remains robust, with total equity increasing to 29.46 billion shillings from Ksh 25.69 billion in the previous year. This improvement in equity shows Britam’s strengthened financial position and underscores its ability to weather economic uncertainties.

“Britam’s strong performance in 2024 reflects the success of our strategic focus on profitable growth, operational efficiency, and investment optimization. Our disciplined execution of the EPIC2 strategy continues to drive sustainable value for our shareholders while reinforcing our position as a leading financial services provider in the region,” said Britam’s Group MD & CEO Tom Gitogo.

The year under review marks the fourth year of Britam’s implementation of its five-year strategic plan for the period 2021-2025 with the positive outcome achieved through relentless focus on the customer, innovation and Britam’s strategic product diversification.

Related Content: Britam General Insurance Pays Ksh 71 Million Fire Claim To Limuru Country Club

“In 2024, beyond publishing our Sustainability Report and installing solar carports to reduce carbon emissions, we enhanced transparency by adopting several global sustainability reporting frameworks, including those focused on climate risk and nature-related financial disclosures, while reinforcing our commitment to gender equality through the UN Women Empowerment Principles,” added Mr. Gitogo.

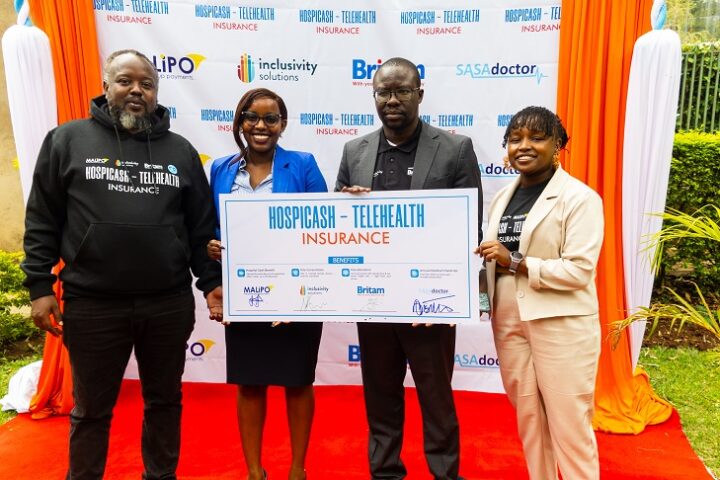

Britam is also betting on its microinsurance unit, Britam Connect, which is expanding insurance access to underserved communities and gig workers. By leveraging technology and strategic partnerships, the company is driving sustainable growth while making insurance more inclusive and relevant to everyday financial transactions.

When asked whether Britam still had plans to kick off operations in the Democratic Republic of Congo (DRC), Gitogo said, despite the ongoing tension in Goma and DRC in general, the Group is till putting in place plans to invest the vast country.

Related Content: Britam Officially Launches A Microinsurance Subsidiary