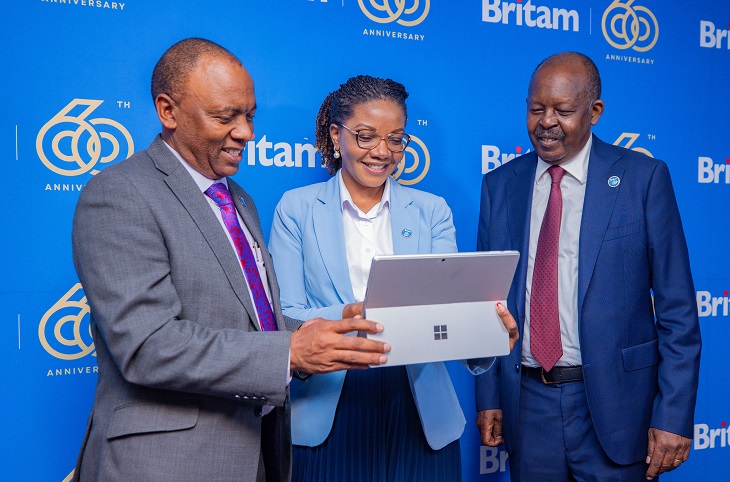

Britam Holdings Plc held its 29th Annual General Meeting (AGM) where shareholders engaged leadership on strategic updates, growth plans, and financial performance.

The AGM, as Britam marks 60 years of operations, highlighted growing investor confidence as the diversified financial firm continues to laser focus on innovation, financial inclusion, and long-term regional growth.

Britam reported strong financial results for 2024 despite a mixed macroeconomic environment. Profit Before Tax grew by 52% to Kshs 7.3 billion, while net investment income surged by 163% to Kshs 30.6 billion — a testament to the Group’s prudent investment strategy and effective risk management. Britam also recorded a 34% growth in insurance revenue, with both our Kenyan and regional businesses contributing significantly.

“We are committed to providing accessible, affordable financial solutions to all segments of society,” said Group Managing Director and CEO Tom Gitogo.

He added: “With the continued support of our stakeholders, we are confident in our ability to navigate change, unlock opportunity, and deliver lasting impact.”

In response to shareholder inquiries, Group CEO Tom Gitogo reaffirmed Britam’s intent to expand regionally, noting that groundwork is underway for market entry into the DRC. He described it as a “high-potential market” and part of Britam’s wider strategy to deepen financial inclusion across Africa.

Gitogo also addressed questions around the Group’s dividend policy. While 2024’s results were robust, the Board has decided not to declare a dividend at this time. This decision is due to the retained earnings at the holding company level, from which dividends are paid, still being negative.

On innovation, Julius Mungai, Chair of Britam’s ICT Board Committee, indicated that the Group’s digital transformation is well underway, with technology playing an increasingly central role. AI is now embedded across core operations including underwriting and claims to data-driven customer engagement, resulting in better experiences, faster turnaround, and improved risk management.

The AGM also spotlighted Britam’s strategic milestones in 2024. The Group’s EPIC² strategy, enabled successful expansion into Uganda with new Life Insurance operations, alongside the launch of micro-insurance solutions across underserved markets.

Britam reported solid progress under a new ESG framework aligned to global standards. In 2024, the Group installed solar panels at Britam Centre and, through its Foundation, delivered clean water to 21 rural schools in Kenya, positively impacting over 28,000 lives. Maternal health initiatives were also scaled, delivering health literacy and quality care to expectant mothers.

Looking ahead, Britam reiterated its ambition to be Africa’s leading diversified financial services provider. Focus areas include deeper customer personalization powered by AI, expansion of microinsurance across new markets, and strategic partnerships to deliver inclusive and affordable financial solutions at scale.

“As we celebrate 60 years of Britam, we reflect on our journey with immense gratitude to our loyal customers, partners, employees, and shareholders who have been part of our journey,” said Britam Board Chairman Kuria Muchiru.

“This milestone is not just a celebration of our past achievements, but also a springboard for the next 60 years of growth, innovation, and impact,” he said.

Related Content: Britam’s BetaLab Relocates To Two Rivers