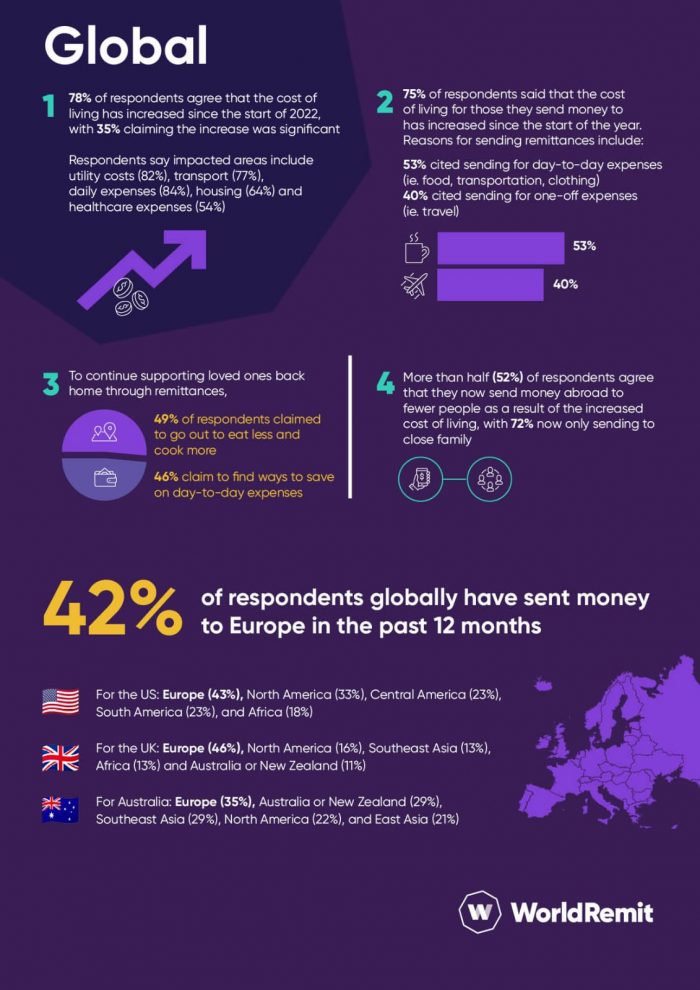

WorldRemit has released the results of a survey it conducted in July to understand the impact of the global rise in the cost of living on remittances sent back home by migrants living and working in the US, the UK, and Australia.

WorldRemit, which serves more than 5 million customers across 130 countries worldwide, including Kenya, received responses from 1000 migrants in each of the countries surveyed, bringing the total number of respondents to 3000. Below is a summary of the survey’s key findings.

- Globally, 78% of remittance senders agree that the cost of living has increased for themselves

- 75% of respondents said that the costs of living for those they send money to have increased since the start of the year

- Daily expenses, healthcare, and educational support continue to be major reasons for sending

- The survey also shows that migrants around the world have changed their spending habits during this period of inflation to maintain their financial obligation to family and loved ones back home.

- 49% reported that they eat out less, 46% save on day-to-day expenses, 28% limit social gatherings to save money, and 25% opt for public transportation rather than driving themselves

“Migrants’ resilience and commitment to their loved ones back home has proven to be vital, especially in a period where household expenses are increasing around the world,” said Jorge Godinez Reyes, Head of the Americas, WorldRemit.

The resilience of remittances is welcome news for Kenya considering money sent back home by Kenyans in the diaspora represents one of the top sources of forex for the country, surpassing tourism, tea, and horticultural exports in recent years.

Data from the Central Bank of Kenya (CBK) shows that remittances reached USD 3.71 billion (Sh421.98 billion) in 2021, up 20.2 percent from USD 3.09 billion (sh351.46 billion) a year earlier. Remittances in Kenya have hit a record high every year since 2016.

WorldRemit notes that the continued shift to digital remittance technologies has made it more convenient and affordable for those in the diaspora to send money back home.

The London-based digital remittances firm also noted that Kenya is among the top 3 countries in Africa where WorldRemit users globally send money to. The company processed transactions to Kenya worth 170 million GBP (approx. Sh24.47 billion) as of June 1st, 2022. This figure puts Kenya at par with Zimbabwe and second only to Nigeria, where WorldRemit users globally sent 270 million GBP (approx. Sh38.86 billion).