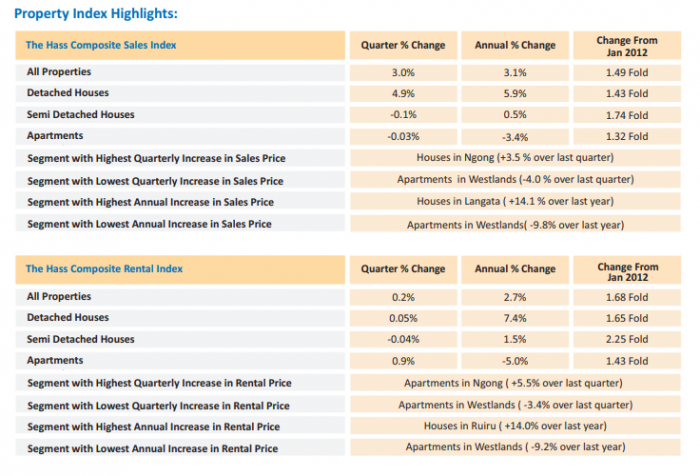

Asking prices for properties in Nairobi and satellite towns increased by 3 percent over the quarter, driven by detached houses which improved by 4.9 percent according to the latest Index by HassConsult.

“Over the last two decades, we have seen the property market composition significantly change. Whereas slightly more than half of the advertised properties were detached houses in 2001, today they make up around 9.5 percent of the market,” said Ms. Sakina Hassanali, Head of Development Consulting and Research at HassConsult.

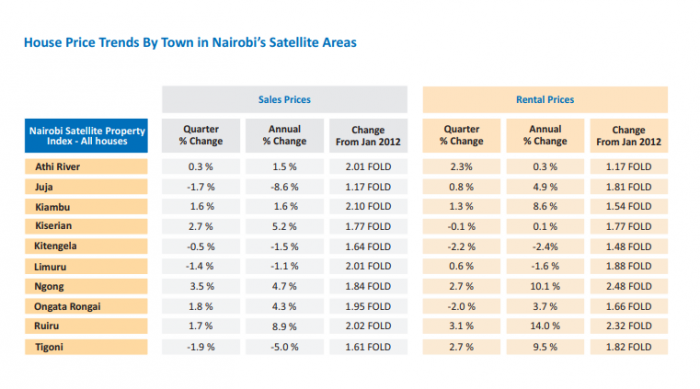

At the same time, the semi-detached apartments were static droppings by 0.1 and 0.03 percent respectively. Houses in Westlands were the best performing among the suburbs with a 3 percent return while in the towns, Ngong emerged top with a 3.5 percent.

Detached houses accounted for 52 percent of the housing market in 2001 but by the end of 2021, this share had reduced to 9.5 percent, resulting in increased prices as buyers compete for these scarce units. House prices in Runda retreated by 0.9 percent while Tigoni saw prices reduce by 1.9 percent.

Gigiri has the most expensive properties with the average housing commanding an average of 122 million shillings price tag. Rents remained static at 0.2 percent with houses in Ridgeway’s recording a 2.5 percent increase while apartments in Ruaka recovered with a 4.5 percent appreciation over the quarter.

The annual average is representative of the average price of all mid to upper-class properties offered for sale in Kenya. The average value for property has gone from 7.1 million in December 2000 to 32.5 million in December 2021.

The average value for a 4-6 bedroom property is currently 39.0 million. The average value for a 1-3 bedroom property is currently 12.9 million.

On the rental front, the market was static at 0.2 percent while Ridgeways saw houses record a 2.5 percent increase while Ruaka apartments saw a 4.5 percent increase.

Gigiri houses recorded a 1.8 percent drop in rent over the quarter and by 8.8 percent over the year. Kitengela posted a 2.2 percent drop over the quarter while Thika apartments saw prices drop by 4.3 percent.

Related Content: Land Prices In Kiambu County Are Coming Down: What Should Investors Expect?