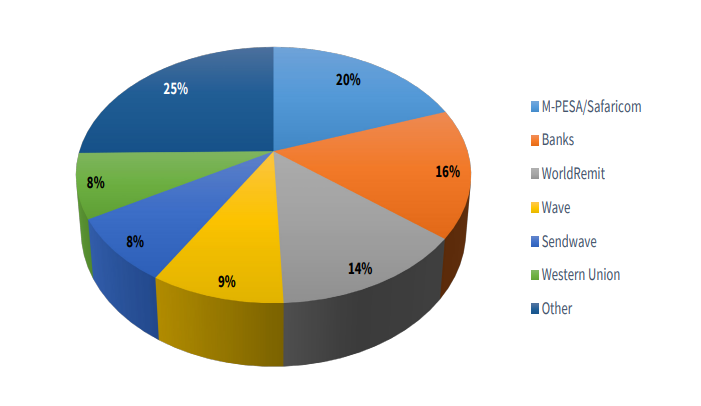

A survey by the Central Bank of Kenya on Diaspora Remittances showed that Kenyans living in foreign countries prefer M-Pesa while sending cash back home. “M-PESA/Safaricom is the most preferred service provider, selected by 20 percent of the respondents.”

According to CBK, the most preferred channels while sending cash back home are:

-

M-Pesa

-

Banks

-

WorldRemit

-

Wave

-

Sendwave

-

Western Union

-

Other

20 percent of Kenyans in other countries use M-Pesa while sending cash back home. 16 percent use banks while 14 percent use WorldRemit. 9 percent use Wave while those who use SendWave and Western Union respectively are at 8 percent.

M-Pesa is the most preferred channel Kenyans use to send cash home

“Whereas mobile money operators are the most frequently used service providers, the proportion of funds transferred through the top three service providers are almost similar,” said CBK in the survey.

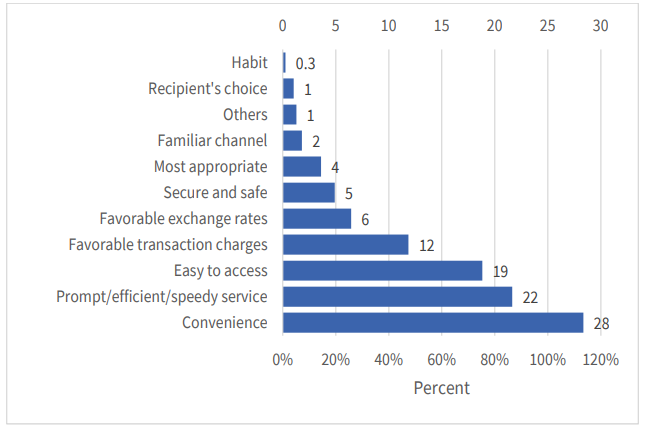

As to reasons why most Kenyans choose to use a particular service provider to send cash from the diaspora, 0.3 percent say it is a habit, 1 percent say it depends on the choice of the recipient while 2 percent use a channel because it is familiar.

The majority of Kenyans would use a channel to send money because of convenience.

4 percent say they would choose to use the most appropriate channel while 5 percent will go for one that is secure and safe. At 28 percent, the majority use a channel because of convenience while 22 use it for speedy/efficient/speedy services.

“Respondents cited convenience, prompt/efficient/ speedy service, ease of access, and favorable transaction charges as the main reasons for using these service providers,” CBK noted in the survey.

CBK says that Hawala operators were preferred for offering favorable transaction charges, convenience, and ease of access. Credit Union is considered desirable due to the security and safety of the channel, convenience, and favorable

exchange rates.

Apart from the case of courier companies, the recipient’s choice isn’t a major consideration in the choice of channels.

Courier firms were deemed most expensive when compared to mobile money operators where the average cost of remitting was 4.7 per cent of the amount being remitted while the cost for money transfer companies was 4 per cent and banks 3.7 per cent.

“The survey revealed that over 70 per cent of respondents reported remitting cash mainly sent through formal channels, predominantly money transfer companies, banks and mobile money operators.

2 comments

UnVZSMuLKvkmxi

[…] Read More: Here Are Most Preferred Service Providers For Sending Cash From Diaspora […]

Comments are closed.