For years, Kenya has remained one of the most technology-advanced countries in Africa, which has had many christen it the Silicon Savannah.

In recent years, most of Kenya’s technological innovation has been centered on the mobile phone, with several mobile innovations either originating from Kenya or using the country as a launchpad to the rest of the continent.

A mobile phone has been one of the integral parts of life for virtually every Kenyan. According to the Communications Authority, Kenya’s mobile penetration stands approximately at 119.9 percent. At the same time, a study conducted by Pew Research found that 80 percent of adults in Kenya own a mobile phone, with 30 percent owning a smartphone and 50 percent owning a basic phone.

The advancement in mobile technology in Kenya has often shaped how people consume various products and services. For instance, mobile technology has had a significant positive impact on the banking sector. Most commercial banks in Kenya have up to 90 percent of their transactions conducted via mobile.

With the coming of a smartphone and the spread of the internet, there has been significant growth in the uptake of e-commerce. Kenya’s e-commerce space has grown exponentially in the past three years. This is the practice of buying and selling goods or services via the internet, and the transfer of money and data to complete the sales. Transactions can take place between businesses, individuals, and vice versa.

The uptake of e-commerce services in Kenya hit its peak at the height of the Covid-19 in the country. With movements restricted and most businesses shut, the majority moved to online platforms to buy, sell and trade. Many have come to love e-commerce platforms because they are affordable, convenient because the products and services are delivered, and most secure too.

Talking of convenience, the consumers of today have placed a high premium on convenience – being able to access products and services from anywhere, anytime. They want to view product options and make a purchase from the comfort of their home.

Mostly when people talk about e-commerce, the emphasis is always on the convenience of the customer. Rarely do we talk about what the platforms mean for the seller. E-Commerce helps the vendor display products and services online, and while at it, reach as many potential customers as possible. The platforms also allow customers to select what they want, put it in a shopping cart and proceed to a checkout page where they can confirm the items and total cost. What is more, they allow customers to receive payment from the customer right there on the website.

When it comes to payment, the majority of e-commerce platforms have provided an M-Pesa Paybill or till numbers for the customer to pay. Few of them have adopted online card acceptance solutions that allow customers to pay directly on the website, such as the Co-opBank online card acceptance solution.

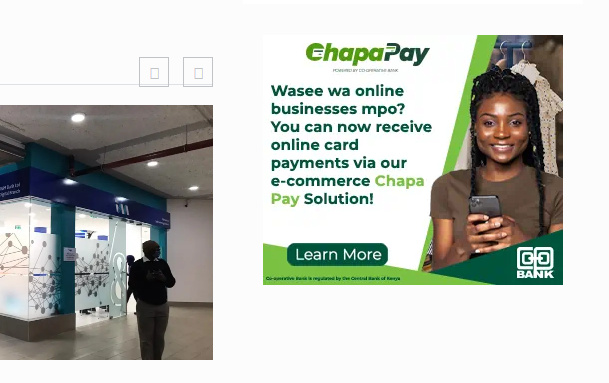

With Co-opBank e-commerce, anyone who promotes goods and services on the online space, e.g., via a website, social media platforms, WhatsApp is in a position to get more customers by accepting online card payments via Chapa Pay, Co-op Bank’s eCommerce solution. The eCommerce solution allows one to receive online card payments from their customers directly into their Co-op Bank account.

1 comment

[…] Co-op Bank Goes Into Uplifting E-Commerce, Develops A Robust Platform For SMEs […]

Comments are closed.